One purpose.

One integrated strategy.

Better performance.

Successful e-commerce requires an integrated strategy, with all components working in harmony. Here are our main areas of expertise:

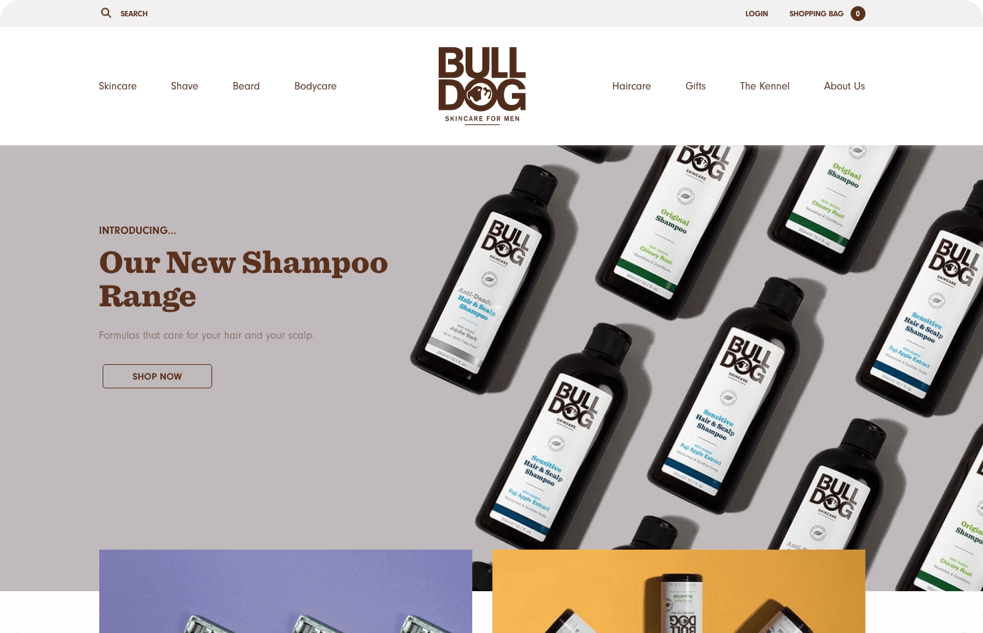

E-Commerce

Grow your business with an expertly-designed Shopify or Magento website that is built bespoke for you. Customisable, scalable, and fully supported.

Paid Acquisition

Using a mix of Paid Search, Social, and Programmatic, we’ll help you reach your potential customers in an instant.

Organic Marketing

You don’t always have to pay to be seen; we’ve developed a range of services from SEO to Content Marketing to help you reach your target audience.

Explore All Our Services